People Counting System Market Size:

The People Counting System Market Size was valued at USD 1.0 billion in 2023 and is expected to reach USD 3.101 billion by 2032 and grow at a CAGR of 13.4 % over the forecast period 2024-2032.

Get more information on People Counting System Market - Request Sample Report

The market for people counting systems is poised to grow significantly as these systems proliferate in various industries, particularly in the retail and transportation industries. The growth of retail, especially in the Asia-Pacific region, and the development of smart cities are creating a strong demand for People Counting System solutions. According to a data, smart city market size is projected to reached $2.09 trillion, by 2025. this showed the growth in people counting systems in upcoming future. Also, Technological advances such as artificial intelligence and the Internet of Things drive innovation and create new opportunities for People Counting System. for eg, ShopperTrak owned by Tyco Retail Solutions offers people counting systems that integrate with AI to provide retailers with real-time customer traffic data and analytics. This allows retailers to optimize staffing levels, product placement, and marketing campaigns based on actual customer behavior.

People Counting System Market Dynamics:

KEY DRIVERS:

-

The development of smart cities creates a strong demand for crowd management solutions.

-

Advancements in technologies like AI and Internet of Things (IoT) are driving the market growth for people counting systems.

Advancements in technologies like Artificial Intelligence (AI) and Internet of Things (IoT) are creating new opportunities for people counting systems. AI can analyze data collected by these systems to provide deeper insights into customer behavior and optimize store operations. For example, AI might identify "hot zones" where customers linger and "cold zones" with minimal traffic. Wegmans, this supermarket chain utilizes AI-powered people counting systems to analyze customer flow and optimize checkout lane staffing. Cameras track customer movement, and AI predicts checkout wait times, prompting managers to open additional lanes when necessary.

RESTRAINTS:

-

High Cost of Advanced Systems This might deter smaller businesses with limited budgets.

-

Growing concerns about data privacy can hinder the adoption of people counting systems

A 2022 study by Pew Research Center found that 72% of Americans are concerned about the amount of data collected by companies about their activities. especially those that utilize facial recognition or other personal data collection methods.

OPPORTUNITIES:

-

Integration with Building Management Systems

-

Installation of human computer systems in workplaces is increasing.

Beyond traditional applications in retail and public spaces, people counting systems are making a big splash in the workplace. Office managers, owners, and developers are increasingly recognizing the value these systems bring to optimizing workspace utilization. Furthermore, people counting systems contribute to a more sustainable and productive work environment. They can help improve HVAC efficiency by adjusting heating and cooling based on real-time occupancy data. Additionally, the data can inform staffing adjustments, ensuring enough resources are available during peak times and avoiding unnecessary staffing during slow periods. Ultimately, people counting systems are a powerful tool for creating a cost-effective, efficient, and comfortable work environment.

CHALLENGES:

-

The upfront cost of purchasing, installing, and maintaining people counting systems can be high, especially for small and medium-sized businesses.

-

Accuracy and Reliability Issues can creates Challenges

The accuracy of people counting systems can be affected by various factors like lighting conditions, shadows, people moving in groups, or using carts. Inaccurate data can make the system less useful for businesses.

IMPACT OF RUSSIA-UKRAINE WAR

Many components for people counting systems are manufactured in Asia, but rely on raw materials or subcomponents from Russia or Ukraine. The war can disrupt these supply chains, leading to shortages and price hikes for these systems. For example, a retail chain planning to deploy people counting systems in Eastern Europe might delay the project due to the uncertain economic climate and potential supply chain disruptions. also, The war has heightened cybersecurity concerns globally. Businesses might be wary of implementing new technology, especially if it involves data collection, due to potential security risks.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns often lead to reduced consumer spending. This leads to fewer people visiting stores, malls, and other locations that typically use people counting systems. With lower foot traffic, the perceived value of these systems might decrease. also, the Businesses become more cost-conscious during economic slowdown. This could lead to a shift in demand towards simpler and less expensive people counting solutions. The retail segment, especially brick-and-mortar stores, could be most affected by an economic slowdown. These businesses are highly reliant on foot traffic and might be less inclined to invest in people counting systems during tough times.

People Counting System Market Segment Analysis:

By Offering

Based on Offering, the hardware component holds the largest share in the People Counting System Market, and this trend is expected to continue during the forecast period 2024-2031. and This ability to collect the more accurate data needed to provide the exact number of visitors plays an important role in expanding the hardware supply market. Companies are investing heavily in the development of additional technologies that can operate in complex environments without compromising the efficiency of census systems.

By Technology

Based on Technology, video-based demographics are expected to record the highest CAGR from 2023 to 2030. Growth can be attributed to a significant need for accuracy as these technologies are able to provide a more accurate number of visitors compared to other technologies. These systems are 95% accurate and can count on both indicators; they may be linked to modern analytics systems that help end users with store statistics, stay time, line management, etc.

Infrared is the second dominant segment in 2023. Infrared personal counters are the simplest systems available on the market. Numerical systems based on human infrared rays provide approx 80% accuracy. The growth of the segment is due to the widespread use of infrared people counting systems in small and medium-sized establishments such as retail stores, libraries and museums. In addition, the demand for infrared people counting systems is increasing due to their low cost, easy installation, flexibility and longer battery life.

By Type

Based on Type, the Bidirectional segment holds the largest share in this market, and a similar trend may be observed during forecasting year 2024-2031. this Growth is due to programs such as sales statistics, line management, staff improvement, and space utilization. These People Counting systems can detect when a person enters or exits the door. Allows end users to calculate the number of guests on the floor or in another location, as well as how they used to enter / exit. Sensors used in dual-directed human computation systems can scan areas 200 times / second, allowing them to operate at more than 92% accuracy.

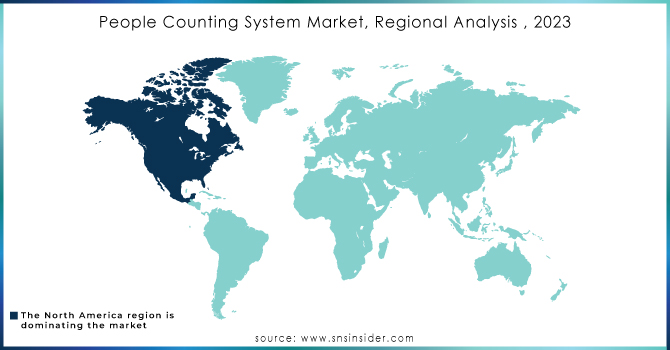

People Counting System Market Regional Analysis:

In 2023, North America hold the largest market share in the people counting system market. This dominance can be attributed to a powerful combination of factors, such as, Early adoption of cutting-edge tech, North American retail stores and transportation facilities are at the forefront of adopting new technologies like AI and IoT. By providing real-time data, AI empowers stores to optimize customer experiences, make smarter business decisions, and manage inventory efficiently.also, A strong presence of Major players, along with their subsidiaries, distributors, and resellers, are all heavily concentrated in North America. This creates a robust ecosystem that drives market growth.

The growth of the people counting system market in Asia Pacific is expected to exceed that of other regions. Moreover, Rapid urbanization is fueling the development of smart cities throughout Asia Pacific. These smart cities require crowd management solutions, which people counting systems can effectively provide. also, Governments in this region are actively promoting digital transformation initiatives. This creates a favorable environment for the adoption of people counting systems, as they align with these digitalization goals. Also, Businesses are increasingly recognizing the advantages of people counting systems. These systems go beyond simply counting people. They offer valuable data that can be used to optimize store layouts, improve customer service, and gain insights into customer behavior. This awareness is further driving market expansion in Asia Pacific.

Get Customized Report as per your Business Requirement - Request For Customized Report

KEY PLAYERS

The major key players are Axis Communications AB (Sweden), RETAILNEXT, INC. (US), Hangzhou Hikvision Digital Technology Co., Ltd. (China), iris-GmbH infrared & intelligent sensors (Germany), VIVOTEK Inc. (Taiwan), V-Count (UK), Eurotech (Italy), and Irisys (Infrared Integrated Systems) (UK). Hella Aglaia Mobile Vision, Shoppertrak, Dilax Intelcom, and other key players.

RECENT DEVELOPMENT

-

In October 2022, Axis Communications AB announced the launch of the Axis P8815-2 3D People Counter. This device integrates 3D imaging software and hardware, allowing for real-time counting of people moving through a designated area.

-

In January 2021, RetailNext, INC. collaboration with Meiyume (China), which provides digital signage, consumer demographic analysis, display traffic analysis and product interaction tracking solutions. Meiyume is looking to expand its IoT capabilities. Using RetailNext's hardware and AI software, Meiyume should help its customers track each customer's entire journey through the store, the product categories they visit, etc., and help make better visual merchandising and store design decisions. The partnership is expected to mark RetailNext's strong position in the beauty industry and open up new opportunities in other segments and regions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.0 Billion |

| Market Size by 2032 | USD3.101 Billion |

| CAGR | CAGR of 13.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware(Thermal Cameras, Infrared Sensors, Fixed Cameras, Fixed Dome Cameras, Pan-tilt-zoom Cameras) And Software) • By Technology (Infrared Beam, Thermal Imaging, Video Based(2D, 3D, 4D), And Others) • By Type (Unidirectional, Bidirectional) • By Mounting Platform (Ceiling, Wall, Floor) • By End-Use (Transportation, Hospitality, Industrial, Retail, And Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Axis Communications AB (Sweden), RETAILNEXT, INC. (US), Hangzhou Hikvision Digital Technology Co., Ltd. (China), iris-GmbH infrared & intelligent sensors (Germany), VIVOTEK Inc. (Taiwan), V-Count (UK), Eurotech (Italy), and Irisys (Infrared Integrated Systems) (UK). Hella Aglaia Mobile Vision, Shoppertrak, Dilax Intelcom |

| Key Drivers | • The development of smart cities creates a strong demand for crowd management solutions. • Advancements in technologies like AI and Internet of Things (IoT) are driving the market growth for people counting systems. |

| Restraints | • High Cost of Advanced Systems This might deter smaller businesses with limited budgets. • Growing concerns about data privacy can hinder the adoption of people counting systems |